CFA Program - Level I

The first in a series of three exams of the CFA Program is focused on acquiring basic knowledge across a wide range of industry related topics, including asset valuation, financial reporting & analysis and portfolio management techniques.

Curriculum Contents

| Topic | Weight | Functional Area |

|---|---|---|

| Quantitative Methods | 6 - 9% | Tools |

| Economics | 6 - 9% | |

| Financial Statement Analysis | 11 - 14% | |

| Corporate Issuers | 6 - 9% | Portfolio Management and Analysis |

| Portfolio Management | 8 - 12% | |

| Equity Investments | 11 - 14% | Assets |

| Fixed Income | 11 - 14% | |

| Derivatives | 5 - 8% | |

| Alternative Investments | 7 - 10% | |

| Ethical and Professional Standards | 15 - 20% | Ethical and Professional Standards |

Exam Structure

The Level I exam is 100% multiple choice (three answer choices) consisting of 180 questions split between two sessions over 4.5 hours.

Both sessions must be attended with an optional 30-minute break between sessions.

| Session | Duration | Questions | Topics Tested |

|---|---|---|---|

| First Session | 2hrs, 15min | 90 | Ethical and Professional Standards, Quantitative Methods, Economics, Financial Statement Analysis |

| Second Session | 2hrs, 15min | 90 | Corporate Issuers, Equity, Fixed Income, Derivatives, Alternative Investments and Portfolio Management |

| Total | 4hrs, 30min | 180 | 90 seconds (1.5 minutes) / question |

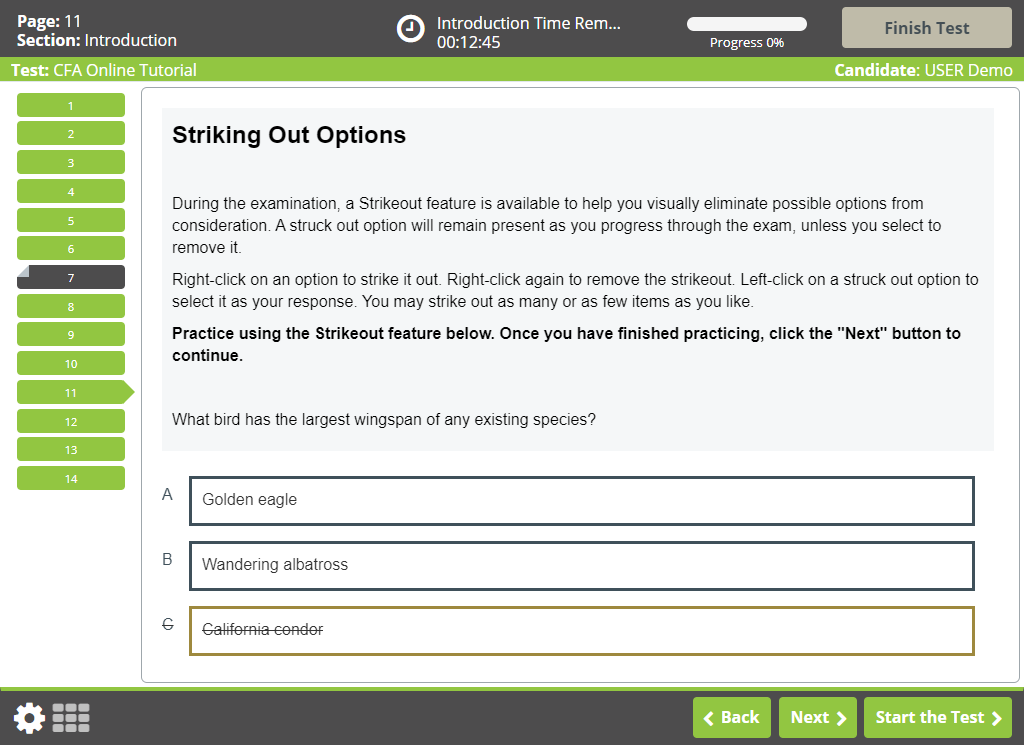

As of August 2021, the CFA exams switched to computer-based testing (CBT) format. The practice testing component of all our study packages are designed to closely simulate the look and feel of the actual exam so candidates are familiar with the layout and functionality come exam day.

Exam Results

- Exam results for Level I are provided via email approximately 7 - 10 weeks (~ 60 days) after the corresponding exam period.

- Results are designated as either "pass" or "fail". Included in the exam results email is a performance report outlining general results per topic.

- A minimum passing score (MPS) is implemented by the CFA Institute for each exam. The MPS is not made public before or after the exam. Although the MPS is not disclosed, it is estimated candidates should aim for a score of above 70%.

Note, the minimum passing score is not to grade the results on a curve, but rather to establish a minimum difficulty hurdle. - Pass rates for the Level I exam is usually in the 40% range.

Level I Exam Dates

May 2026 Exam Period

-

12 Aug 2025Registration & Scheduling Opens

-

14 Oct 2025Early Registration Deadline

-

03 Jan 2026Invoice Payment Deadline

-

12 Feb 2026Registration Closes

-

18 Feb 2026Scheduling Deadline

-

01 May 2026Rescheduling Deadline

-

12 - 18 May 2026CFA Exam Dates

Aug 2026 Exam Period

-

18 - 24 Aug 2026CFA Exam Dates

Nov 2026 Exam Period

-

11 - 17 Nov 2026CFA Exam Dates

FAQ - Level I

| Topic | Weight | Functional Area |

|---|---|---|

| Quantitative Methods | 6 - 9% | Tools |

| Economics | 6 - 9% | |

| Financial Statement Analysis | 11 - 14% | |

| Corporate Issuers | 6 - 9% | Portfolio Management and Analysis |

| Portfolio Management | 8 - 12% | |

| Equity Investments | 11 - 14% | Assets |

| Fixed Income | 11 - 14% | |

| Derivatives | 5 - 8% | |

| Alternative Investments | 7 - 10% | |

| Ethical and Professional Standards | 15 - 20% | Ethical and Professional Standards |

According to a recent survey conducted by the CFA Institute the average study hours of CFA Level I candidates was 303 hours.

As of 2021, the CFA Institute transitioned to a computer-based format for the Level I exam.

It continues to be a multiple choice (three-option) format, which consists of 180 multiple choice questions split between two 2 hour & 15-minute sessions. The sessions are split by an optional 30-minute break.

- First session (90 questions) covers ethics & professional standards, quantitative methods, economics, and financial statement analysis

- Second session (90 questions) covers corporate issuers, equity, fixed income, derivatives, alternative investments and portfolio management

Overall this gives candidates an average of 90 seconds to answer each question. Candidates are not penalized for incorrect answers.

The exam is conducted in english language only.

- February

- May

- August

- November

For additional Level I exam dates see here or refer directly to the institute website: CFA Institute

The following outlines the registration deadlines for the scheduled upcoming CFA Level I exams:

| Exam Sitting | Registration Deadline | Exam Dates |

|---|---|---|

| Feb 2026 | Oct 29, 2025 | Feb 2 - 8, 2026 |

| May 2026 | Feb 12, 2026 | May 12 - 18, 2026 |

| Aug 2026 | TBD | Aug 18 - 24, 2026 |

| Nov 2026 | TBD | Nov 11 - 17, 2026 |

For additional Level I exam dates see here or refer directly to the institute website: CFA Institute

- Bachelor's Degree

- Student in Final Year

- Complete Professional Conduct Statement